This Week in Biotech #43

Catch up on the latest biotech breakthroughs and upcoming trends (Mar 7-13).

Welcome back to This Week in Biotech by Biotech Blueprint, edition 43.

THIS WEEK’S KEY TAKEAWAYS 🔑

The biotech sector continues to navigate choppy market waters with resilience. While broader markets went down significantly this week, biotech stocks are holding up, highlighting the sector’s reduced correlation with economic cycles. Against this backdrop, several significant deals and clinical milestones emerged that deserve investors’ attention, regardless of the current market sentiment:

Market resilience: biotech outperformed the broader market (-1.5% vs. S&P’s -3.5%), showing defensive potential amid economic uncertainty.

Deals: Roche/Zealand’s $5.3B obesity partnership and Ionis/Ono’s $280M blood disorder agreement signal strong industry investment. Smaller acquisitions (BMS/2seventy, Sun/Checkpoint) indicate strategic portfolio optimization rather than transformative megadeals.

Treatment breakthroughs: Beam’s base-editing therapy showed first in human success; Gilead’s once-yearly HIV prevention injection advances; Novo’s obesity combo demonstrated 15.7% weight loss.

Obesity market expansion: Multiple developments (Roche, Novo, Viking) confirm obesity treatment remains biotech’s hottest competitive landscape for 2025.

Thanks again for reading Biotech Blueprint and for supporting this effort.

🎙️ PODCAST

MARKET UPDATES

🔹 The S&P 500 continued its decline this week, dropping 3.5% since the last This Week in Biotech edition on Mar. 7, bringing its total pullback to 9.3% from its Feb. 19 peak. Trade tensions and growing macroeconomic concerns, particularly around tariffs and their impact on consumer confidence, have weighed on investor sentiment.

Despite the broader selloff, biotech stocks showed relative resilience. The S&P Biotechnology Select Industry Index (SPSIBI) fell 1.5% over the past week, outperforming the broader market, though it remains down 7.1% from the S&P 500’s peak.

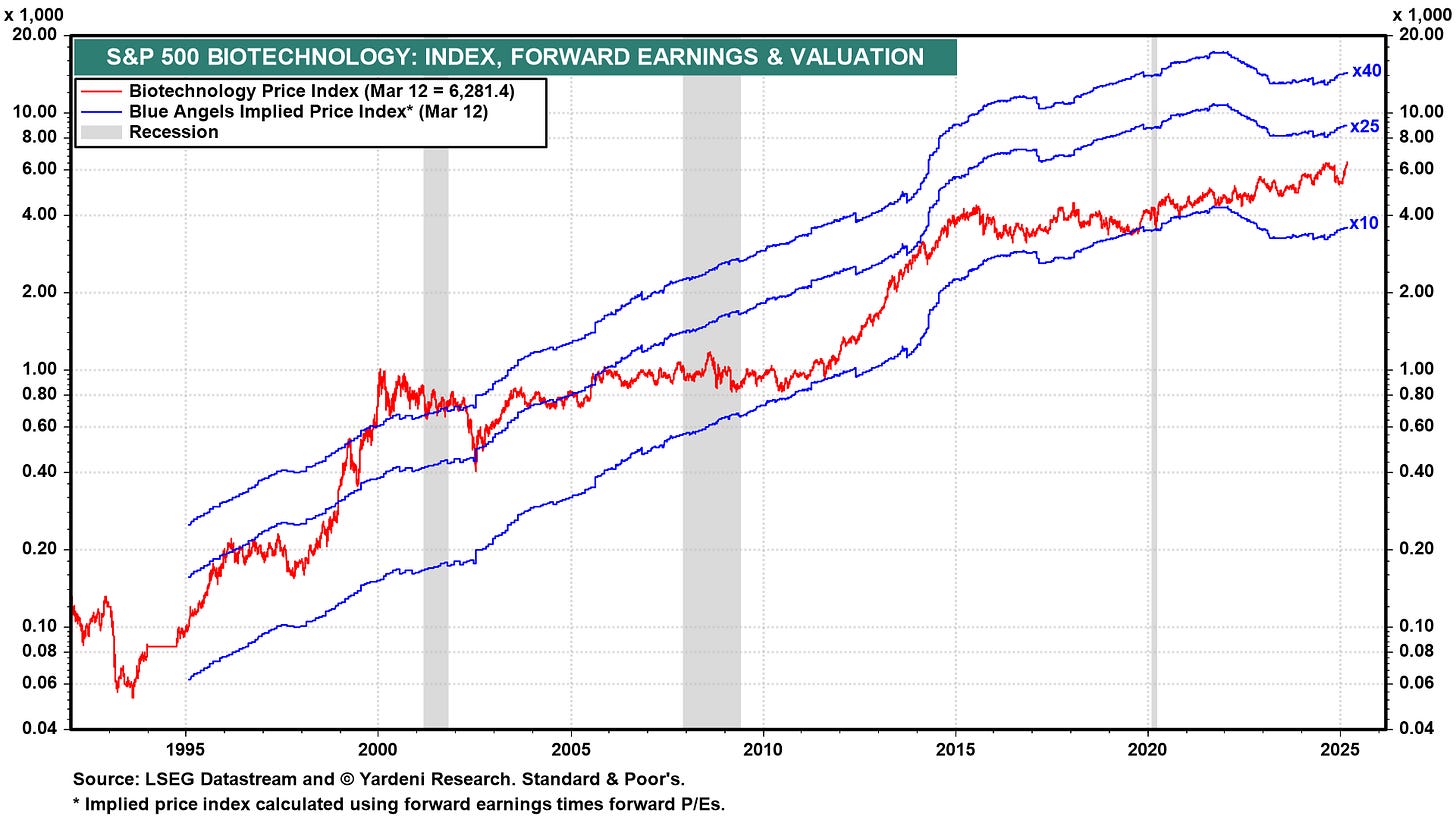

One notable observation from today’s S&P 500 Biotechnology Index chart (currently at 6,275.26 [ABBV, AMGN, BIIB, GILD, INCY, MRNA, REGN, VRTX]) is that biotech valuations remain relatively reasonable compared to many sectors currently trading at premium multiples. Unlike other industries experiencing significant P/E compression concerns, biotech has not seen the same degree of valuation expansion that is worrying investors elsewhere.

When looking at biotech’s implied price bands (10x, 25x, and 40x forward P/E), the sector remains in a position that suggests potentially less downside risk. For investors seeking exposure to innovation-driven growth with lower correlation to economic cycles, biotech stands out as an intriguing opportunity in today’s uncertain market environment.

On a positive macroeconomic note, February’s Producer Price Index (PPI) came in softer than expected, signaling slowing inflation. While this offers some relief, the broader market remains fragile as investors weigh economic uncertainty against sector-specific opportunities.

BIOTECH NEWS

🔹 MeiraGTx has partnered with Hologen AI to accelerate phase 3 development of AAV-GAD, a gene therapy for Parkinson’s disease, and enhance manufacturing. MeiraGTx will receive $200M upfront, while their joint venture, Hologen Neuro AI Ltd, will be fully funded with $230M from Hologen to support AAV-GAD and other CNS therapies. MeiraGTx retains 30% ownership in the joint venture and will lead clinical development and production. AAV-GAD has shown significant motor function improvements in Parkinson’s patients and is phase 3-ready, with in-house commercial manufacturing underway. The deal extends MeiraGTx’s cash runway and creates a first of its kind Neuro-AI drug development venture, combining AI-driven disease modeling with gene therapy. The transaction is expected to close in Q2 2025, pending regulatory approvals.

🔹 Zai Lab has announced that Chinese regulators has accepted the application for Tivdak (tisotumab vedotin-tftv) for the treatment of recurrent or metastatic cervical cancer in patients whose disease has progressed after systemic therapy. Tivdak, the first antibody-drug conjugate approved for cervical cancer, has shown a 45% reduction in the risk of death compared to chemotherapy in the global phase 3 innovaTV 301 trial, with the China subpopulation demonstrating consistent survival benefits. If approved, Tivdak will expand Zai Lab’s oncology portfolio, leveraging its commercial infrastructure for Zejula (niraparib), a leading ovarian cancer treatment. Cervical cancer remains a major health issue in China, with 150,000 new cases annually and limited treatment options. Tivdak was fully approved by the U.S. FDA in 2024 and licensed to Zai Lab from Seagen (now part of Pfizer) for commercialization in China.

🔹 On Mar. 12, Ionis Pharmaceuticals and Ono Pharmaceutical entered a global licensing agreement for sapablursen, an RNA-targeted therapy for polycythemia vera (PV), a rare and potentially life-threatening blood disorder. Under the deal, Ono gains exclusive worldwide rights to develop and commercialize sapablursen, while Ionis will complete the ongoing phase 2 IMPRSSION trial before handing over full development responsibilities. Ionis will receive a $280M upfront payment and is eligible for up to $660M in milestone payments, plus mid-teen royalties on net sales. Sapablursen, which received Fast Track and orphan drug designations from the FDA in 2024, aims to regulate iron metabolism to reduce red blood cell overproduction and thrombotic risks in PV patients. The agreement allows Ionis to streamline its portfolio and focus on its independent commercial launches, while Ono expands its hematology pipeline with a promising late-stage asset.

🔹 Roche has signed an exclusive collaboration and licensing agreement with Zealand Pharma to co-develop and co-commercialize petrelintide, a long-acting amylin analog currently in phase 2 clinical trials for obesity. The partnership will also explore a fixed-dose combination of petrelintide with Roche’s dual GLP-1/GIP receptor agonist CT-388, aiming for enhanced weight loss efficacy and tolerability. Zealand Pharma will receive up to $5.3B. Profits and losses will be shared 50/50 in the U.S. and Europe, with Roche holding exclusive rights outside these regions. Petrelintide, designed for once-weekly subcutaneous administration, has shown potential for significant weight loss with improved tolerability, positioning it as a foundational obesity therapy.

🔹 Viking Therapeutics has entered into a multi-year manufacturing agreement with CordenPharma to support the commercialization of its obesity treatment candidate, VK2735. Viking will make prepayments totaling $150M between 2025 and 2028, credited against future orders, while retaining all global rights to VK2735 and expecting standard pharmaceutical product margins. Currently, VK2735 is undergoing a phase 2 oral dosing trial, with phase 3 development for the subcutaneous formulation planned for Q2 of 2025. Analysts view this agreement as a significant step toward Viking potentially becoming the third company to launch a branded GLP-1 drug, following industry leaders Eli Lilly and Novo Nordisk. The deal addresses previous investor concerns about Viking’s manufacturing scalability and supply chain reliability, especially amid existing shortages of GLP-1 drugs. Projections suggest that VK2735 could achieve substantial revenue, with estimates reaching up to $39B if priced similarly to competitors.

🔹 Bristol Myers Squibb acquired 2seventy bio for $5.00 per share, valuing the transaction at approximately $286M. The acquisition aligns with 2seventy bio’s strategic focus on Abecma, a BCMA-directed CAR T cell therapy for multiple myeloma. The deal is expected to close in Q2 2025, subject to regulatory approvals and the tendering of a majority of outstanding shares. Following completion, 2seventy bio’s stock will be delisted from Nasdaq.

🔹 Genmab announced that J&J has decided not to exercise its option to receive a worldwide license to develop, manufacture, and commercialize HexaBody-CD38 (GEN3014). Despite promising initial clinical data showing robust efficacy, Genmab will not pursue further clinical development of HexaBody-CD38. The decision follows a comprehensive evaluation of the data, market landscape, and Genmab’s strategic portfolio prioritization. While disappointed by the decision, Genmab emphasized that the clinical data validated the potential of its HexaBody platform. The company remains focused on its pipeline, including the ongoing development of Epcoritamab (EPKINLY), Rinabart sesutecan (Rina-S), and Acasunlimab, all of which are in late-stage clinical trials.

🔹 Emergent BioSolutions has announced the sale of its Baltimore-Bayview drug substance manufacturing facility to Syngene International for $36.5M. The facility includes manufacturing, laboratory, warehousing, and office space with monoclonal antibody production lines. Despite the sale, Emergent will retain the right to secure manufacturing services at the site for future needs, including pandemic response production.

🔹 Sun Pharma has announced its acquisition of Checkpoint Therapeutics for $4.10 per share in cash, totaling $355M, with an additional $0.70 per share contingent on regulatory approval in Europe. This acquisition adds Unloxcyt (cosibelimab-ipdl), the first FDA-approved anti-PD-L1 treatment for metastatic and locally advanced cutaneous squamous cell carcinoma, to Sun Pharma’s oncology portfolio. Checkpoint reported $0.04M in revenue and a $27.3M net loss for the nine-month period ending Sept. 2024. The deal is expected to close in Q2 2025, pending regulatory and shareholder approvals.

CLINICAL TRIAL UPDATES

🔹 Gilead Sciences presented first clinical data on its once-yearly injectable lenacapavir for HIV prevention at CROI 2025 and published findings in The Lancet. The phase 1 study showed that two different once-yearly intramuscular formulations maintained effective plasma concentrations for at least 56 weeks, exceeding levels seen in previous twice-yearly lenacapavir trials (PURPOSE 1 and 2). Safety data indicated the drug was well tolerated, with mild injection site pain as the most common side effect. Gilead plans to launch a phase 3 trial in the second half of 2025. Additionally, new PURPOSE 1 survey data revealed that 2/3 of participants preferred twice-yearly lenacapavir over once-daily oral PrEP, with adolescents particularly favoring injections. Lenacapavir remains investigational for PrEP and has not yet been approved for this use.

🔹 Novo Nordisk announced positive results from its REDEFINE 2 trial, a phase 3 study evaluating CagriSema (a fixed-dose combination of cagrilintide and semaglutide) in adults with obesity or overweight and type 2 diabetes. The trial demonstrated significant weight loss, with CagriSema leading to a 15.7% weight reduction after 68 weeks compared to just 3.1% in the placebo group. Notably, 89.7% of patients on CagriSema lost at least 5% of their body weight, a co-primary endpoint. CagriSema was well-tolerated, with the most common side effects being mild to moderate GI issues. Novo Nordisk plans to file for regulatory approval in Q1 2026. Following the announcement, stocks of other companies developing obesity treatments, including Viking Therapeutics, Altimmune, and Structure Therapeutics, saw declines in value.

🔹 On Mar. 10, Mineralys Therapeutics announced positive topline results from its phase 2 and 3 pivotal trials evaluating lorundrostat for the treatment of uncontrolled and resistant hypertension. Both trials showed statistically significant and clinically meaningful reductions in systolic blood pressure, with lorundrostat demonstrating a favorable safety and tolerability profile. Mineralys CEO Jon Congleton highlighted the potential of lorundrostat as a transformative therapy for millions of patients with hypertension. The company plans to present full results from these trials at the American College of Cardiology Scientific Sessions later this month. Following the announcement, Mineralys Therapeutics’ stock (MLYS) surged by more than 50%.

🔹 Beam Therapeutics announced positive initial data from its phase 1/2 trial of BEAM-302, a base-editing therapy targeting alpha-1 antitrypsin deficiency (AATD). Results showed that a single dose of BEAM-302 led to dose-dependent increases in functional AAT levels, production of corrected M-AAT protein, and reduction of the harmful mutant Z-AAT protein, which causes lung and liver damage in AATD patients. BEAM-302 was well tolerated across all dose levels, with no serious adverse events or dose-limiting toxicities. These findings establish clinical proof-of-concept for in vivo base editing, marking a major milestone in genetic medicine. Beam plans to continue dose escalation and present updated trial data in the second half of 2025. If successful, BEAM-302 could become the first one-time treatment for AATD, potentially curing both lung and liver disease by correcting the underlying genetic mutation.

PUBLIC HEALTH SPOTLIGHT

🔹 The U.S. CDC is planning a large study into potential connections between vaccines and autism, despite extensive research disproving any such link. This decision comes amidst a significant measles outbreak in Texas and New Mexico, driven by declining vaccination rates, and is influenced by concerns raised by public figures, such as Robert F. Kennedy Jr., who has expressed doubts about vaccine safety. While there is no scientific evidence linking vaccines to autism, autism diagnoses have risen in the U.S., largely due to broader screening practices. Many scientists attribute the rise in autism diagnoses to increased awareness and changes in diagnostic criteria, not vaccines. However, some public figures, including Kennedy, continue to promote the idea of a vaccine-autism connection, despite it being debunked. This new CDC study, while not yet detailed, raises concerns about fueling public doubts about vaccines. Public health experts emphasize that the causes of autism are still unclear, with some research suggesting maternal factors and birth complications may play a role.

Here is a statement from the Autism Science Foundation:

ON THE HORIZON

🔹 March 2025 FDA PDUFAs:

Mar. 18: NT-501, developed by Neurotech Pharmaceuticals, is a treatment designed for Macular Telangiectasia Type 2 (MacTel), a rare neurodegenerative eye disease that causes progressive central vision loss. NT-501 uses a cell-based delivery system, known as Encapsulated Cell Therapy, to provide sustained release of ciliary neurotrophic factor, a neuroprotective protein that supports photoreceptor survival and slows retinal degeneration.

Mar. 23: Vutrisiran is an investigational RNAi therapeutic being developed by Alnylam for the treatment of ATTR amyloidosis with cardiomyopathy (ATTR-CM), a serious and progressive disease characterized by misfolded transthyretin proteins that accumulate in tissues such as the heart. This therapy works by reducing both mutant and wild-type transthyretin (TTR) proteins, addressing the underlying cause of ATTR amyloidosis. If approved, vutrisiran would be the first therapy available to treat both the polyneuropathy and cardiomyopathy manifestations of this disease.

Mar. 26: Gepotidacin is a novel, oral antibiotic developed by GSK that is currently under investigation for the treatment of uncomplicated urinary tract infections (UTIs) and gonorrhea.

Mar. 27: Milestone’s Etripamil nasal spray, with a PDUFA date of Mar. 27, is designed to be self-administered as a nasal spray to rapidly treat episodes of paroxysmal supraventricular tachycardia (PSVT), a type of abnormal heart rhythm, allowing patients to manage their symptoms at home without immediate medical intervention; it works by blocking calcium channels in the heart to slow down the rapid heart rate.

Mar. 28: Sanofi’s Fitusiran is an investigational therapy for hemophilia A or B, used to prevent bleeding in patients, including those with inhibitors. It works by lowering antithrombin to enhance blood clotting, and is administered subcutaneously, potentially reducing treatment frequency to just six doses a year.

Have a great rest of your week and thanks for reading Biotech Blueprint.

👩🏻💻 BIOTECH BLUEPRINT CONSULTING

I provide tailored consulting solutions designed to meet the unique challenges of both established companies and startups. My services span a wide range of strategic and technical needs, including:

Research strategy & grant writing

Scientific communication & medical affairs

Data analysis & interpretation

Biotech/pharma innovation & technology assessment

Startup advisory services

I also provide daily Biotech Blueprint newsletters and custom daily analysis (charts & graphs) for individuals and companies.

BOOK A FREE 30-MINUTE CONSULTATION OR A MEET & GREET below.

DISCLAIMER: This content is for informational purposes only. It should not be taken as legal, tax, investment, financial, or other advice. The views expressed here are my own and do not reflect the opinions of any company or institution.

DISCLOSURE: I have no business relationships with any company mentioned in this article.

Thanks Katerina! I wrote a post about biotech in China, a topic that’s been grabbing headlines, in my substack https://open.substack.com/pub/chinahealthpulse/p/biotech-in-china-four-important-truths?utm_campaign=post&utm_medium=web