This Week in Biotech #38

Catch up on the latest biotech breakthroughs and upcoming trends (Jan 31-Feb 6).

Welcome to This Week in Biotech by Biotech Blueprint!

THIS WEEK’S KEY TAKEAWAYS 🔑

This week’s updates highlight some key challenges and opportunities in the pharma and biotech sectors. Donald Trump’s talk of higher tariffs could hit companies like Zai Labs and AstraZeneca, particularly those with strong ties to China, though geographically diversified supply chains might help. Bristol Myers Squibb is aiming to cut costs by $2B, but its revenue forecast for 2025 falls short of Wall Street’s expectations, pointing to ongoing pressure from generic competition. Meanwhile, Metsera’s IPO surge shows strong investor interest in obesity treatments.

Valneva’s approval of the first chikungunya vaccine is a huge win for the company, while Amgen saw its stock rise despite a clinical hold on its obesity drug. AbbVie faces challenges from its acquisition of Cerevel Therapeutics, but strong sales from Skyrizi and Rinvoq could provide a financial cushion.

In clinical trials, Sangamo Therapeutics made progress with its gene therapy for Fabry disease, while Equillium’s ulcerative colitis drug showed promising results.

Read the edition or listen to the podcast below for more interesting stories from this week and I hope you enjoy This Week in Biotech.

🎙️ PODCAST

MARKET UPDATES

🔹 Higher tariffs discussed by President Trump could impact pharmaceutical companies, especially those with strong ties to China or manufacturing overseas. Companies like Zai Labs, AstraZeneca, and Johnson & Johnson, with significant partnerships in China, might face challenges. European pharmaceutical firms such as Novo Nordisk, Roche, and AstraZeneca could also be impacted due to their U.S. market exposure, with tariffs potentially raising costs and reducing margins. However, analysts believe that Big Pharma’s geographically diversified supply chains and recent U.S. manufacturing expansions may help mitigate these impacts, although the effects remain uncertain.

🔹 Bristol Myers Squibb plans to cut $2B in costs by 2027 to ensure long-term growth, expanding an earlier initiative to save $1.5B by 2025. These cuts will focus on streamlining operations and enabling more investment in drug development. However, the company issued a 2025 revenue forecast of $45.5B, falling short of Wall Street’s $47.36B expectation. This outlook is influenced by competition from generics affecting several of its drugs, including Eliquis and Opdivo. Despite the weaker forecast, Bristol Myers exceeded Q4 earnings expectations, driven by strong sales of Eliquis and its growth portfolio.

🔹 Metsera (MTSR) saw its stock surge 54% after its $275M IPO, with shares opening at $25.50, up from the $18 per share pricing, and peaking at $28.87. The company, based in New York, focuses on developing ultra-long-acting obesity treatments. Its lead drug candidate, MTE-097i, is in phase 1/2 testing. The IPO involved 15.3M shares, with underwriters granted an option to purchase up to 2.3M additional shares. Major players in the GLP-1 drug market, like Novo Nordisk and Eli Lilly, are competitors in this space.

🔹 AbbVie reported a Q4 loss of $22M due to a $3.5B impairment charge from its Cerevel Therapeutics acquisition. Despite this, Q4 revenue exceeded expectations at $15.1B, driven by strong growth in Skyrizi and Rinvoq, which grew 58% and 46% YoY, respectively. Humira’s revenue dropped 49% YoY. Adjusted earnings per share fell 23% to $2.16. AbbVie maintained its 2025 earnings outlook of $12.12 to $12.32 per share and raised long-term revenue projections for Skyrizi and Rinvoq to over $31B by 2027.

BIOTECH NEWS

🔹 Valneva (VALN) announced that its chikungunya vaccine, Ixchiq, has received marketing authorization in the U.K., making it the world’s first and only vaccine for the virus. The approval follows successful phase 3 trials, showing the vaccine induces a strong immune response with lasting protection. Ixchiq is now approved in multiple regions, including the U.S., Europe, and Canada, with further approvals expected in Brazil. This announcement has driven Valneva’s stock up nearly 19%. The vaccine is seen as crucial for travelers to endemic areas, particularly with ongoing outbreaks in India.

🔹 Amgen (AMGN) stock rose 6.5% despite the FDA placing its obesity treatment, AMG 513, on clinical hold, halting testing in patients. The company did not specify the reason but believes the issue is not related to the drug itself. This setback does not affect Amgen’s other weight-loss drug, MariTide, which is undergoing a midstage study for type 2 diabetes. Amgen’s 2025 guidance projected adjusted earnings of $20 to $21.20 per share, slightly below analysts’ expectations, but its sales forecast of $34.3B to $35.7B exceeded projections. The company also had strong Q4 results, with sales rising 11% to $9.09B. Amgen’s focus remains on products like MariTide and olpasiran, an experimental drug for cardiovascular issues.

🔹 Robert F. Kennedy Jr.’s nomination for U.S. Secretary of Health and Human Services passed a crucial Senate vote on Feb. 4, despite significant controversy. Kennedy, a vaccine conspiracy theorist and former Democrat, faced opposition due to his past claims about vaccines, sexual misconduct allegations, and other conspiracy theories. His nomination was particularly contentious among Democrats, while Republicans had concerns over his past positions on abortion and environmental lawsuits. However, Republican Senator Bill Cassidy supported Kennedy, securing his passage. Kennedy’s nomination reflects President Trump’s influence on the Republican Party.

🔹 Natera has announced that one of the largest U.S. payors will provide national commercial coverage for its Fetal RhD noninvasive prenatal test (NIPT), starting January 2025. This test, which determines fetal RhD status from a pregnant patient’s blood, helps prevent alloimmunization, a condition that can lead to hemolytic disease. The policy will cover patients at risk for alloimmunization, those unable to undergo paternal antigen typing, or those who decline amniocentesis. The test can be performed as early as nine weeks gestation, expanding access to important prenatal care nationwide.

CLINICAL TRIAL UPDATES

🔹 Sangamo Therapeutics has shared encouraging updated data from its phase 1/2 STAAR study of ST-920, a gene therapy for Fabry disease. The results demonstrate sustained elevation of alpha-galactosidase A (α-Gal A) activity for up to 47 months in the longest-treated patient, with significant improvements in kidney function. Notably, all 18 patients initially on enzyme replacement therapy (ERT) successfully discontinued ERT, with no need for re-initiation. The treatment was well-tolerated, with no significant adverse effects or study discontinuations. Moreover, patients showed marked improvements in quality of life.

🔹 Equillium (EQ) announced positive results from its phase 2 study of itolizumab for moderate to severe ulcerative colitis (UC). The drug showed a 23.3% clinical remission rate after 12 weeks, outperforming placebo (10%) and matching adalimumab (20%). It also achieved key secondary endpoints, including 16.7% endoscopic remission. Itolizumab was well tolerated, with no new safety concerns. These promising results contributed to a stock increase of over 25%. The study involved 90 patients and was co-sponsored by Equillium and Biocon. Itolizumab targets the CD6-ALCAM pathway, critical in immune-inflammatory diseases.

🔹 Kura Oncology announced positive results from the phase 2 KOMET-001 trial of ziftomenib in relapsed/refractory NPM1-mutant acute myeloid leukemia, with plans to submit an NDA to the FDA by Q2 2025. Despite the positive trial news, Kura’s stock fell 9%, while rival Syndax Pharma, which is advancing a similar drug candidate, saw a gain. The companies expect multiple clinical data updates in 2025, including for ziftomenib and other pipeline programs.

🔹 A 24-year-old participant, Hannah Richardson, is helping test a preventive Alzheimer’s drug in a new clinical trial led by Washington University School of Medicine. The trial, called the Primary Prevention Trial, aims to stop Alzheimer’s disease before symptoms appear by testing a drug called remternetug. It involves young adults aged 18 to 25 who are at high risk due to family history and genetic mutations linked to early-onset Alzheimer’s. Richardson’s family has a long history of Alzheimer’s, and her mother has been involved in Alzheimer’s research since Richardson was a child. Participants in the trial take either a placebo or the investigational drug, which is injected every three months. The goal is to prevent amyloid plaques, which are believed to contribute to the disease’s development. Researchers believe early intervention may prevent symptoms from emerging altogether. Endpoint News has written an interesting article on this topic.

PUBLIC HEALTH SPOTLIGHT

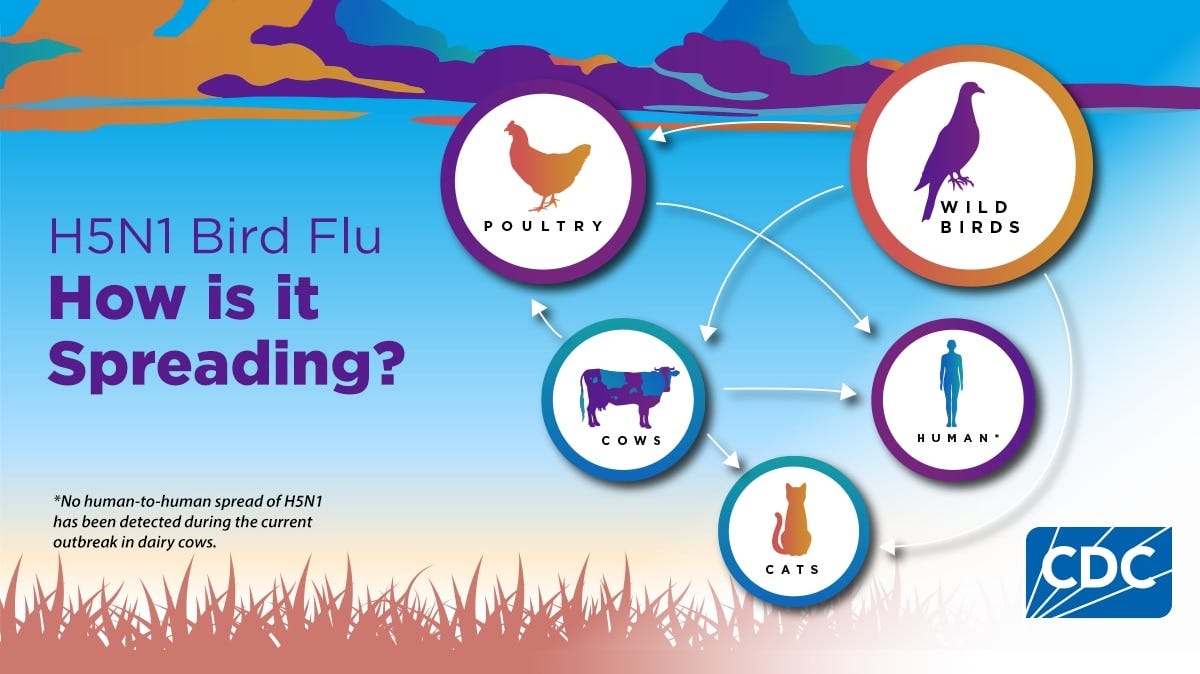

🔹 An update on bird flu: H5 bird flu (H5N1) is spreading globally, with outbreaks in wild birds, poultry, and dairy cows in the U.S. There have been confirmed human cases, mostly among U.S. dairy and poultry workers, but the public health risk remains low. As of today, there have been 67 confirmed human cases and one death from the virus in the U.S. The CDC is monitoring the situation through flu surveillance systems, targeting people with animal exposures, but no person-to-person transmission has been reported. The virus has affected over 156 million poultry and 959 dairy herds across 51 states. Protective measures, such as avoiding contact with sick or dead animals, using personal protective equipment, and consuming pasteurized milk, are recommended. While the current public health risk is low, the CDC continues to assess the situation and provide guidance to reduce exposure.

🔹 An article worth reading from my alma mater, Johns Hopkins University, discusses the U.S.’s relationship with the World Health Organization (WHO) and the potential consequences of withdrawing from it. Dr. Judd Walson, a leading expert in international health, highlights the essential roles of the WHO in global health security, including detecting health threats, setting global health standards, and providing technical and humanitarian assistance. The U.S. is the largest contributor to the WHO and its withdrawal could severely impact both global health efforts and the U.S.’s diplomatic standing. Despite criticism of the WHO’s performance during the COVID-19 pandemic, particularly its handling of vaccine distribution and data transparency, Dr. Walson argues that leaving the WHO could be far more costly. It would disrupt disease surveillance, reduce the U.S.’s influence in global health decisions, and ultimately harm both global and American health outcomes. He emphasizes that health issues transcend national borders and the U.S. benefits from the WHO’s work in reducing disease globally, which in turn helps improve domestic health. While the Trump administration initiated a U.S. withdrawal order, the article stresses that diplomatic efforts should focus on addressing the WHO’s shortcomings rather than abandoning it. Without the U.S. in the WHO, important health information and decision-making power could be inaccessible, weakening global responses to emerging diseases.

ON THE HORIZON

🔹 February FDA PDUFAs:

Feb. 1: Supernus Pharmaceuticals is expecting decision for the apomorphine infusion device (SPN-830) for the continuous treatment of motor fluctuations in Parkinson’s disease. APPROVED✅

Feb. 8: Otsuka and Lundbeck expecting to hear from the FDA regarding the combination of brexpiprazole and sertraline for treating PTSD in adults.

Feb. 14: GSK’s 5-in-1 meningococcal ABCWY vaccine candidate.

Feb. 14: Bavarian Nordic is expecting the FDA’s decision for the CHIKV VLP vaccine.

Feb. 28: SpringWorks Therapeutics’ NDA mirdametinib for treating adults and children with NF1-PN.

Have a wonderful rest of your week and thanks for reading Biotech Blueprint!

👩🏻💻 BIOTECH BLUEPRINT CONSULTING

I provide tailored consulting solutions designed to meet the unique challenges of both established companies and startups. My services span a wide range of strategic and technical needs, including:

Research strategy & grant writing

Scientific communication & medical affairs

Data analysis & interpretation

Biotech/pharma innovation & technology assessment

Startup advisory services

I also provide daily Biotech Blueprint newsletters and custom daily analysis (charts & graphs) for individuals and companies.

BOOK A FREE 30-MINUTE CONSULTATION OR A MEET & GREET below.

DISCLAIMER: This content is for informational purposes only. It should not be taken as legal, tax, investment, financial, or other advice. The views expressed here are my own and do not reflect the opinions of any company or institution.

DISCLOSURE: I have no business relationships with any company mentioned in this article.