This Week in Biotech #17

Catch up on the latest biotech breakthroughs and upcoming trends (Oct 7-8).

Welcome to the Wednesday edition of This Week in Biotech by Biotech Blueprint!

📣 I am excited to share that you can now listen to This Week in Biotech as a podcast. Starting today, you can access episodes right here, through the Podcast tab on Substack, or on Spotify. You can also listen to all previous This Week in Biotech editions.

The episodes are currently AI-generated, but I plan to record future ones, especially deep dives and the Startup Spotlights series. While this isn’t perfect, the quality is pretty great, making it ideal for those who don’t have time to read —now you can stay updated on the go!

MARKET UPDATES

🔹 On Oct. 8, Relief Therapeutics (RLFTF) announced promising preliminary results from a clinical trial evaluating RLF-TD011, a hypochlorous acid solution with strong antimicrobial properties to treat epidermolysis bullosa, a rare genetic skin disorder. The drug significantly reduced Staphylococcus aureus in EB wounds, increased beneficial bacteria, and improved microbiome diversity. Following this news, RLFTF’s stock surged nearly 42%.

🔹 On Oct. 8, PTC Therapeutics (PTCT) announced positive results from long-term studies of vatiquinone, a potential treatment for Friedreich ataxia, showing statistically significant benefits in slowing disease progression. The studies demonstrated durable improvements over 144 weeks, with a 50% reduction in disease progression and no serious adverse events were reported. PTC plans to submit a new drug application to the FDA by this Dec. Following the announcement, PTC’s stock surged by 16.5% on Tuesday afternoon.

🔹 On Oct. 7, Gilead Sciences (GILD) was upgraded by Wells Fargo from Equal weight to Overweight, with a raised price target of $100, up from $78, signaling a potential 17.22% upside from its current price of $85.31. Other analysts, including Evercore ISI and Raymond James, have also given favorable ratings, with price targets as high as $95. Gilead’s strong quarterly earnings, highlighted by $6.95B in revenue have contributed to positive market sentiment, along with insider trading activity and increased hedge fund interest.

🔹 On Oct. 7, Scholar Rock (SRRK) surged 335% after announcing positive phase 3 trial results for apitegromab, its investigational treatment for spinal muscular atrophy (SMA). The trial met its primary endpoint, with 30.4% of patients receiving apitegromab showing a significant improvement in motor function compared to 12.5% of those on placebo at 52 weeks. Early motor function improvements were observed as early as week 8. Scholar Rock plans to submit regulatory applications to the FDA and European Medicines Agency in Q1 2025. Shares of SRRK were up 362% by mid-afternoon. The company also initiated an underwritten public offering of $275M in common stock and pre-funded warrants to fund the commercialization of apitegromab, advance its clinical programs, and support its technology platform.

🔹 Hedge funds recently took advantage of a dip in healthcare stocks, with the sector seeing the largest net buying in five months, according to Goldman Sachs. Despite a 3.5% decline in healthcare stocks over the past four weeks, compared to a 4.6% gain for the S&P 500, hedge funds focused on long buys, outpacing short sales by 2.3 to 1. Pharma, biotech, and healthcare services were the most popular subsectors, with buying concentrated in North America and Europe. In contrast, U.S. real estate saw the most short selling, particularly in real estate trusts and office space.

BIOTECH NEWS

🔹 On Oct. 7, Johnson & Johnson announced the discontinuation of the SunRISe-2 study for TAR-200 in muscle-invasive bladder cancer, following a recommendation from an independent data monitoring committee due to lack of superiority over standard chemoradiation. Despite this setback, the company “remains confident in TAR-200’s potential as a transformative therapy.” J&J is targeting an FDA filing for TAR-200 monotherapy in early 2025 and believe in the platform’s potential for over $5B in peak year sales.

🔹 Eli Lilly has appointed Thomas J. Fuchs as its first chief AI officer, effective Oct. 21, 2024. Fuchs will lead AI initiatives across various areas, including drug discovery and clinical trials, and has an extensive background in AI and healthcare, having previously served at Mount Sinai.

🔹 Pfizer has announced the discontinuation of its RSV candidate, sisunatovir, which was acquired as part of its $525M purchase of ReViral in 2022. The company has halted both a phase 2/3 trial and a phase 1 study due to ongoing challenges, including drug-drug interactions with antacids.

🔹 Pfizer and BioNTech won a legal battle in London’s High Court, successfully invalidating two of CureVac’s patents related to mRNA technology used in COVID-19 vaccines. This is part of a broader global dispute involving ongoing litigation in the U.S. and Germany. Pfizer and BioNTech also face a separate case with Moderna, where a July ruling found their Comirnaty vaccine infringed one of Moderna’s mRNA patents. They have been granted permission to appeal that decision.

🔹 On Oct. 7, Black Diamond Therapeutics announced a restructuring plan to focus on its lead program, BDTX-1535, for EGFR-mutant non-small cell lung cancer (NSCLC). The company will deprioritize the BDTX-4933 program. The restructuring includes workforce reductions and the departure of key executives, aimed at extending the cash runway into Q2 2026.

🔹 On Oct. 7, AstraZeneca entered an exclusive license agreement with Chinese CSPC Pharmaceutical Group to develop YS2302018, a pre-clinical small molecule disruptor of Lipoprotein a, which aims to enhance treatment options for dyslipidaemia. AstraZeneca will pay CSPC $100M upfront and may provide up to $1.92B in future milestones and royalties. YS2302018, discovered by CSPC, prevents the formation of Lipoprotein a, a key contributor to cardiovascular diseases.

🔹 On Oct. 7, Judo Bio launched with $100M in funding to develop oligonucleotide therapies aimed at treating kidney diseases. The company’s proprietary STRIKE platform targets specific kidney cells using small interfering RNA (siRNA) to silence genes linked to systemic diseases. Rajiv Patni, M.D., has been appointed CEO, bringing over 25 years of biotech experience. Judo Bio’s team includes industry veterans and experts in oligonucleotide therapies.

🔹 Novo Nordisk and Viatris have reached a settlement in their patent dispute over the weight-loss drugs Ozempic and Wegovy, which had been under review by the U.S. Patent and Trademark Office (USPTO). The conflict centered around Novo’s patent covering specific dosages of the drugs for treating type 2 diabetes and obesity. While the terms of the settlement remain confidential, this resolution follows Novo’s ongoing legal efforts to block generic versions of these drugs, including a lawsuit against Viatris, which has now also been settled.

🔹 Regeneron’s co-founder, George Yancopoulos, has expressed concerns that the popular weight-loss drugs, GLP-1s, could cause long-term harm due to rapid muscle loss. Clinical studies indicate that patients using these drugs, such as Novo Nordisk’s Ozempic and Wegovy, lose muscle at faster rates compared to those losing weight through diet or exercise. Yancopoulos warned that patients who stop these treatments may regain weight with less muscle and higher body fat. Regeneron is testing trevogrumab, a drug aimed at preserving muscle mass when used with GLP-1s. Yancopoulos is raising a cautionary flag while also positioning Regeneron to capture as much of the booming $130B weight-loss market as possible.

CLINICAL TRIAL UPDATES

🔹 On Oct. 8, Sage Therapeutics announced that its phase 2 LIGHTWAVE study of dalzanemdor (SAGE-718) for mild cognitive impairment and mild dementia due to Alzheimer’s Disease failed to meet its primary endpoint, showing no significant difference between treated participants and placebo. While dalzanemdor was generally well-tolerated, Sage will not pursue further development for Alzheimer’s Disease. This represents the company’s third study failure in six months, following the setbacks of SAGE-217 and SAGE-324.

🔹 On Oct. 8, GSK presented positive data from its phase 3 trial for RSV vaccine Arexvy, showing sustained protection over three RSV seasons in adults aged 60+. The vaccine demonstrated 62.9% cumulative efficacy against lower respiratory tract disease and 67.4% against severe disease over three seasons. Efficacy remained notable in older adults with underlying health conditions. The safety profile was consistent with earlier trials. Arexvy competes with Pfizer’s Abrysvo and Moderna’s mRNA-1345, both FDA-approved.

SCIENCE SPOTLIGHT

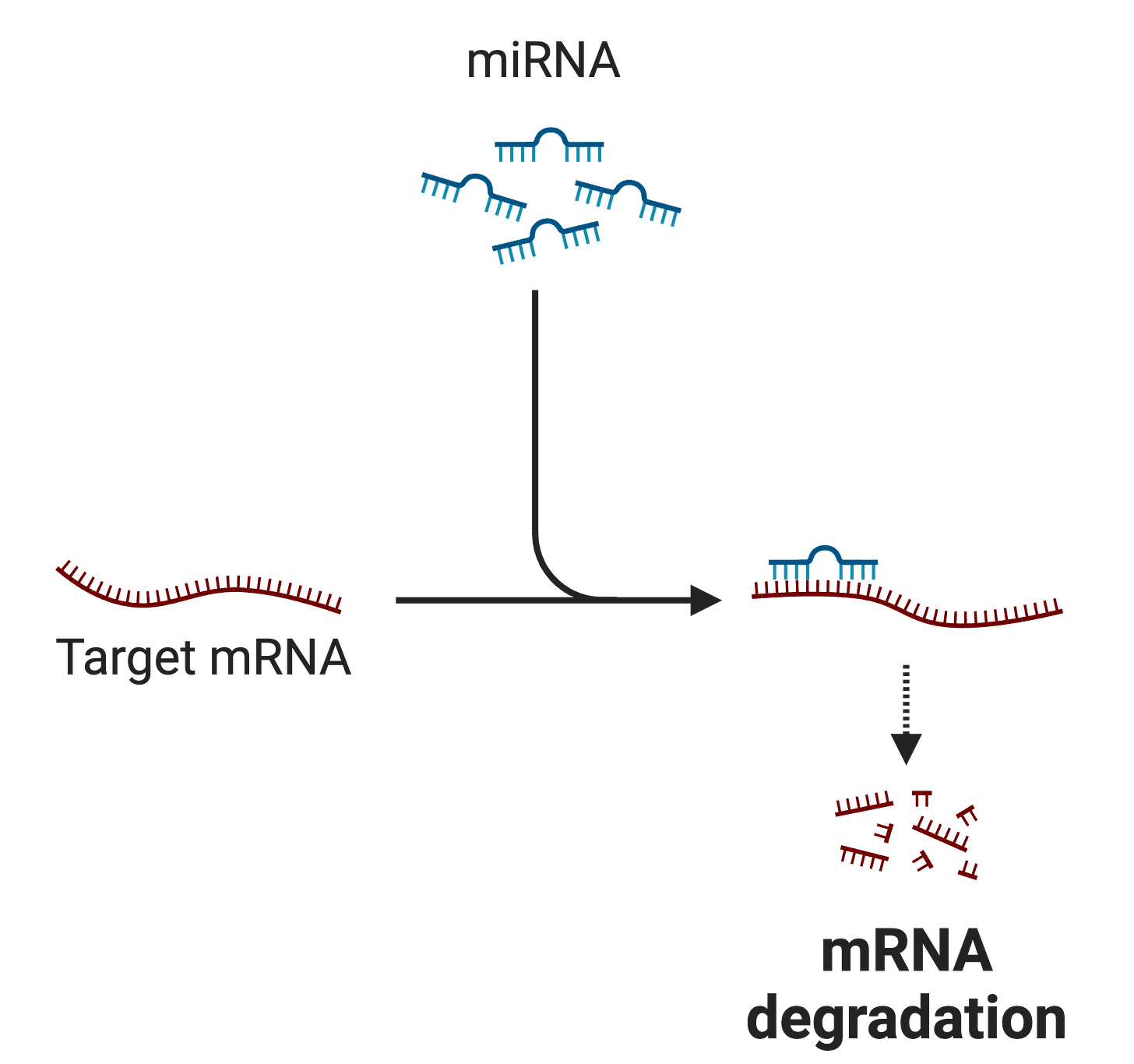

🔹❗ I decided to include Science Spotlight in Wednesday edition because on Monday, Oct. 7, Victor Ambros and Gary Ruvkun were awarded the Nobel Prize in Medicine for their discovery of microRNA, tiny molecules that regulate gene expression. Their research, which began in the 1980s while they were postdoctoral fellows in Robert Horvitz’s lab, revealed that microRNAs, significantly smaller than traditional mRNA, can inhibit gene activity and destabilize mRNA. This discovery has opened new avenues in medical research, particularly in developing treatments for cancer, heart disease, and dementia. Their work has demonstrated the critical role microRNAs play in various biological processes and diseases, leading to innovative drug developments targeting these molecules.

Messenger RNA (mRNA) are molecules that carry genetic information from DNA to ribosomes, where they serve as templates for protein synthesis. MicroRNAs (miRNAs), on the other hand, are short RNA molecules that do not code for proteins. Instead, miRNAs regulate and fine tune gene expression. Their primary function involves binding to target mRNA molecules, leading to their destabilization and degradation, which prevents protein synthesis.

Happy Wednesday and thanks for reading Biotech Blueprint!

DISCLAIMER: This content is for informational purposes only. It should not be taken as legal, tax, investment, financial, or other advice. The views expressed here are my own and do not reflect the opinions of any company or institution.

DISCLOSURE: I have no business relationships with any company mentioned in this article.