RFK Jr. Ends mRNA Funding, Sarepta Beats Q2, and Eli Lilly Falls — This Week in Biotech #64

Biotech Q2 round-up: Sarepta rebounds, Eli Lilly’s oral GLP-1 disappoints, and U.S. vaccine strategy pivots away from mRNA (August 1–7, 2025).

Hi and welcome to This Week in Biotech by Biotech Blueprint, edition 64, covering biotech & pharma news from August 1st to 7th, 2025.

🎙️ Biotech Blueprint brings you weekly video updates on the latest biotech and pharma news, plus in-depth podcast interviews with industry leaders. You can find us on YouTube, Spotify, and Apple Podcasts.

In the latest episode, I teamed up with the Biotech Capital Compass to break down Sarepta Therapeutics’s recent safety crisis, and what the FDA’s partial green light means for Elevidys, investor confidence, and the broader AAV field. We dig into the science, regulatory dynamics, and what might come next.

And the accompanying article published on Subsatck:

THIS WEEK IN BIOTECH VIDEO SUMMARY

THIS WEEK’S KEY TAKEAWAYS 🔑

Q2 earnings season rolled on, with Sarepta delivering a standout report in a week otherwise shaped by regulatory turbulence and shifting vaccine policy.

Sarepta’s comeback gains traction. The company posted Q2 revenue of $611M (+68% YoY) and beat EPS expectations, driven by surging Elevidys gene therapy sales and a $63.5M milestone from Roche following Japanese approval. Shares climbed 7%—a welcome lift after a rough year. Continued uptake abroad and renewed momentum in DMD may shift investor sentiment.

RFK Jr. cancels $500M in mRNA vaccine funding. In a dramatic policy reversal, the U.S. Health Secretary ended federal contracts with Moderna, Pfizer, and others—despite scientific consensus on the platform’s safety and effectiveness. Critics warn the decision could undermine America’s pandemic preparedness and weaken private-sector R&D.

FDA lifts pause on Valneva’s chikungunya vaccine, but adds warnings. Ixchiq is again recommended for those 60+, following safety-related reviews. The revised label includes cautionary language about adverse events in older adults with chronic conditions. Travelers at high risk remain eligible.

Replimune crashes 40% on RP1 rejection fallout. New details revealed that an FDA official intervened late in the review to reject the company’s oncolytic therapy for advanced melanoma, reversing internal support. The move contradicts investor hopes that recent leadership changes would soften the FDA’s stance.

Regeneron receives CRL for odronextamab over Catalent site issues. Though unrelated to the drug’s data, the FDA flagged quality problems at the manufacturing site, affecting one of Regeneron’s most advanced oncology programs. The company expects a fix via Novo Nordisk’s involvement.

Eli Lilly’s oral GLP-1 underwhelms. Orforglipron showed meaningful weight loss in phase 3 (up to 12.4%), but trailed expectations. High dropout rates and comparison to Wegovy spooked investors, sending shares down 12–14%, despite an otherwise strong earnings report.

MARKET UPDATES

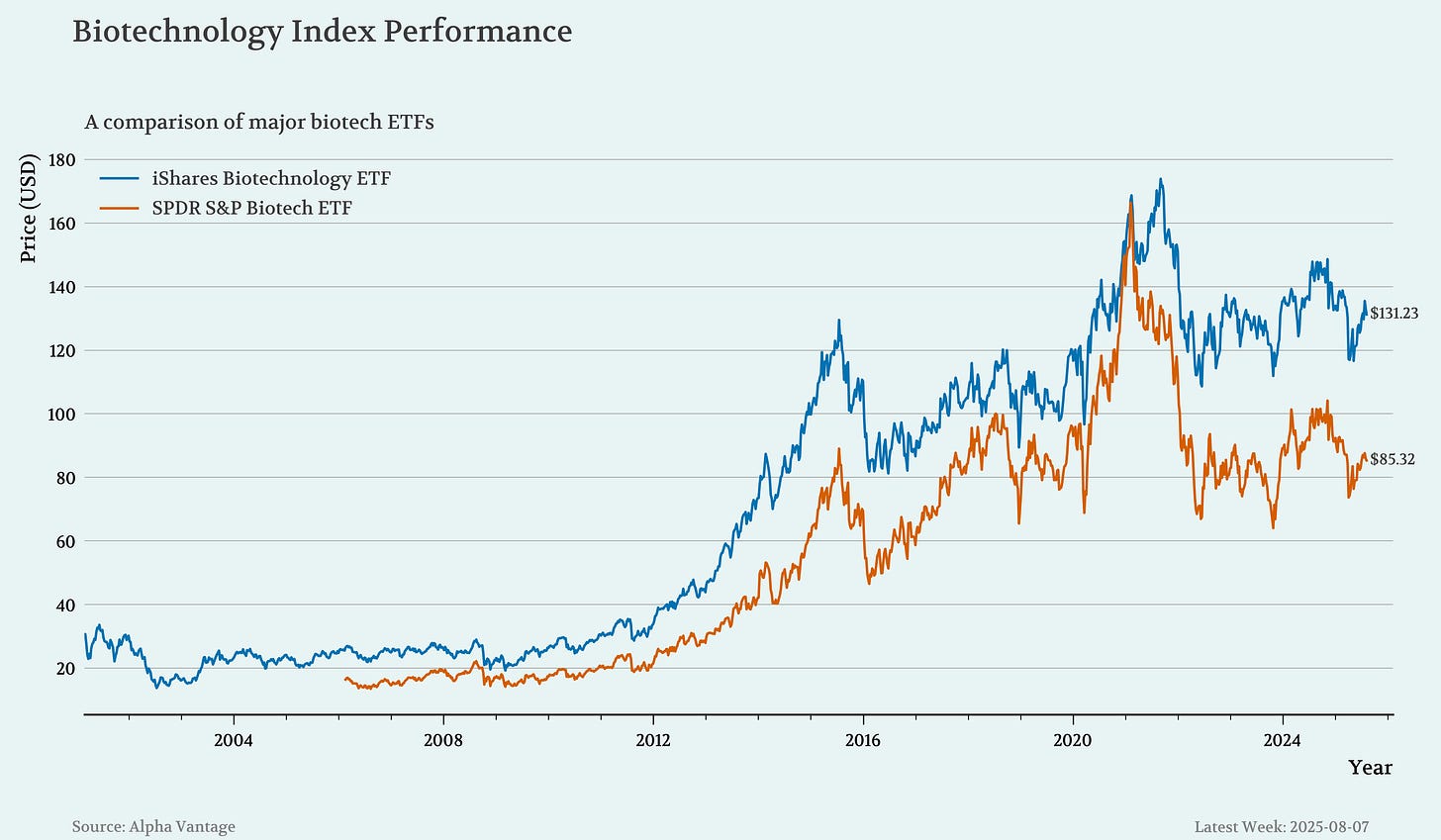

🔹 As of Aug. 7, 2025, the iShares Biotechnology ETF (IBB) is hovering around $131, while the more volatile SPDR S&P Biotech ETF (XBI) sits at approximately $86. Despite periodic rebounds, both ETFs remain well below their peaks: IBB’s 52-week high was nearly $150, and XBI once traded over $105. Year-to-date, IBB has held up relatively better with only a modest decline, whereas XBI has slipped further, weighed down by regulatory pressures and mid-cap biotech volatility.

BIOTECH/PHARMA NEWS 🧬

🔹 Sarepta Therapeutics posted a strong Q2 2025, beating expectations with adjusted EPS of $2.02 (vs. $1.11 expected) and revenue of $611.1M, up 68% year over year. Growth was fueled by Elevidys, its gene therapy for Duchenne muscular dystrophy, which generated $282M in sales, more than doubling from the prior year. Additional revenue came from a $63.5M milestone payment from Roche following Elevidys’ approval in Japan and continued international royalties. The results sent Sarepta shares up over 7%, offering a rare bright spot after a tough year for the stock. Sales of its older RNA-based DMD drugs dipped slightly, but the commercial relaunch of Elevidys and expansion abroad via Roche provide momentum. Investors will be watching closely for sustained uptake and future approvals as Sarepta navigates a competitive and fast-evolving gene therapy landscape.

🔹 Valneva announced that the FDA has lifted its recommended pause on the use of its chikungunya vaccine, Ixchiq, in individuals aged 60+. This update comes after a similar decision by the EMA in July. The FDA also approved revisions to the vaccine’s prescribing information, including expanded warnings about serious adverse events observed primarily in older adults with chronic health conditions during a mass vaccination campaign in La Réunion. While the vaccine remains approved for use in people 18+ at high risk of chikungunya, the FDA emphasized that most U.S. travelers face low risk and should only receive the vaccine when exposure risk is substantial.

🔹 Health Secretary RFK Jr. has canceled $500M in federal funding for mRNA vaccine development, ending 22 contracts, including with Moderna and Pfizer, and signaling a major shift in U.S. vaccine strategy. He cited concerns over mRNA’s effectiveness against upper respiratory viruses and its potential safety risks, despite widespread scientific consensus that mRNA vaccines are safe and were crucial in reducing severe illness and death during the COVID-19 pandemic. The move also removes mRNA from BARDA’s biodefense toolkit, prompting criticism that the U.S. is voluntarily weakening its pandemic preparedness and falling behind global competitors who continue to invest in the platform.

Private sector fallout could be significant. Federal support has historically played a vital role in accelerating vaccine R&D, and this sudden policy reversal may chill investment, particularly for smaller biotech firms working on mRNA-based solutions for flu, RSV, and even cancer. While Kennedy frames the decision as a pivot toward “safer” technologies, most experts view it as politically driven and scientifically unfounded, a move that could undermine both national health security and America’s biotech leadership.

🔹 Replimune shares plunged nearly 40% premarket on Monday after new details emerged about the FDA’s surprise rejection of its oncolytic immunotherapy RP1. While the company disclosed the CRL last month, recent reports reveal that the drug initially had internal support before a senior FDA cancer official intervened late in the review, derailing the application. The rejected BLA sought approval for RP1 in combination with Opdivo (nivolumab) for advanced melanoma. Investors had initially blamed the decision on Vinay Prasad, the recently departed head of the FDA’s Center for Biologics, fueling a 100% rally in Replimune shares following his resignation.

🔹 Regeneron received a Complete Response Letter from the FDA for odronextamab, its CD20xCD3 bispecific antibody in relapsed/refractory follicular lymphoma. The setback stems from manufacturing site issues at Catalent Indiana, the same facility affecting multiple Regeneron filings, including Eylea HD. Notably, the inspection was not specific to odronextamab but still impacted the BLA. Despite the CRL, Regeneron expects a swift resolution, citing Novo Nordisk’s active engagement with the FDA (Novo now owns the Catalent site) and the availability of alternative third-party fillers. This CRL puts a dent in Regeneron’s near-term oncology ambitions as odronextamab was among its most advanced bispecific programs, but does not appear to reflect concerns over the clinical data itself.

CLINICAL TRIAL UPDATES 📊

🔹 Eli Lilly’s oral GLP-1 drug, orforglipron, helped participants lose up to 12.4% of body weight over 72 weeks in a phase 3 trial, showing meaningful efficacy and cardiovascular benefits. Nearly 60% of patients lost at least 10% of their body weight, and the once-daily pill was generally well-tolerated, with side effects consistent with other GLP-1 drugs. Lilly plans to submit the drug for regulatory approval by the end of 2025, positioning it as a convenient alternative to injectable treatments. However, the market reacted sharply to what analysts considered underwhelming results. The placebo-adjusted weight loss lagged behind expectations and trailed competitors like Novo Nordisk’s Wegovy. Higher dropout rates due to side effects also raised concerns. Eli Lilly stock dropped 12-14% on the news, even as the company reported a blowout quarter driven by Mounjaro and Zepbound sales. Analysts say orforglipron’s results may open the door for emerging rivals like Viking and Structure Therapeutics in the oral GLP-1 race.

🔹 Genmab’s phase 3 EPCORE FL-1 trial for relapsed or refractory follicular lymphoma (R/R FL) showed a 95.7% overall response rate and a 79% reduction in disease progression with the combination of epcoritamab, rituximab, and lenalidomide (R2). The FDA has accepted the therapy for priority review with a decision expected by Nov. 30, 2025. If approved, it would be the first bispecific antibody combination available as a second-line treatment for R/R FL in the U.S. With its subcutaneous delivery, strong efficacy, and favorable safety profile, epcoritamab is well positioned to capture significant market share. Genmab’s platform approach and pipeline, backed by partnerships with AbbVie, BioNTech, and argenx, support broader expansion into B cell malignancies and beyond.

🔹 INmune Bio announced that its phase 1/2 trial of INKmune in metastatic castration-resistant prostate cancer met both its primary and secondary endpoints and is now closed to enrollment. The therapy was well tolerated across all dose levels, with strong NK cell activation, particularly in patients with low baseline NK activity. Some patients experienced tumor shrinkage or complete lesion disappearance, suggesting direct tumor-killing effects. INmune plans to advance to a randomized phase 2b trial in less advanced disease, aiming to better quantify clinical benefit.

🔹 Praxis Precision Medicines announced topline results from its phase 2 RADIANT study of vormatrigine, showing a 56.3% median reduction in seizure frequency over 8 weeks in patients with focal onset seizures. Nearly 22% of participants achieved complete seizure freedom during the final 28 days of treatment, and over 54% had a 50% response within the first week. Vormatrigine, a next-generation, functionally selective sodium channel blocker, continues to demonstrate a favorable safety profile with once-daily dosing, no titration, and no food restrictions, differentiating it from current anti-seizure medications.

AI SUMMARY 🎙️

Will resume next week.

Have a great rest of your week and thanks for reading Biotech Blueprint!

👩🏻💻 BIOTECH BLUEPRINT CONSULTING

We have a new consulting website: biotechblueprint.consulting.com!

We provide tailored consulting solutions designed to meet the unique challenges of both established companies and startups. The services span a wide range of strategic and technical needs, including AI automation tools.

BOOK A FREE 30-MINUTE CONSULTATION OR A MEET & GREET below.

DISCLAIMER: This content is for informational purposes only. It should not be taken as legal, tax, investment, financial, or other advice. The views expressed here are my own and do not reflect the opinions of any company or institution.

DISCLOSURE: I have no business relationships with any company mentioned in this article.